[Disclosure: Kent has worked in insurance since 1996. He is an investor in SquareLife, one of the companies mentioned below.]

Insurance activates otherwise-idle resources for socially productive purposes. People need houses. Banks have money. The risk that a house will burn down & leave the bank with a loss, though, rationally prevents banks from lending.

Home-owner’s insurance comes along & transforms risk into opportunity. Now the bank’s risk of loss disappears. The bank writes the loan. People get a house. Contractors get work. The bank locks in a profit. Society benefits. (There are benefits to the policy holder too, but that’s not today’s topic.)

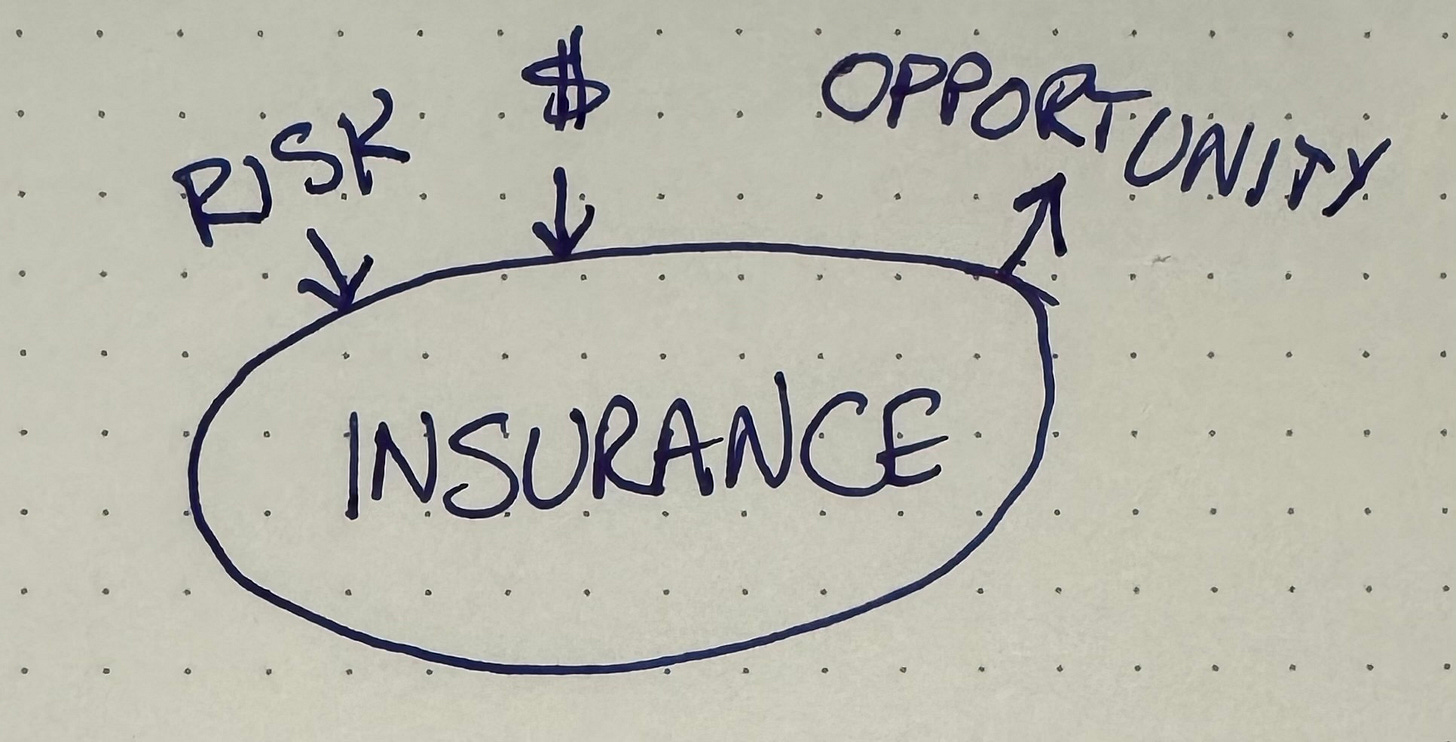

Try a more personal case—an entrepreneur who happens to be a cancer survivor. They have an idea that could create social value. The bank has money to lend. The bank, though, responsibly takes into account the increased risk that the entrepreneur will die during the term of the loan & leave the bank with a loss.

Again, insurance transforms risk into opportunity. By taking out a life insurance policy with the bank as the beneficiary, the bank can now lend, the entrepreneur can start their business, society benefits.

Reality

That’s the theory. In reality, the entrepreneur is unlikely to find coverage. Insurance companies, following a rational series of decisions I outline below, have for decades continually reduced the risks they cover, and so fail to fulfill their social purpose.

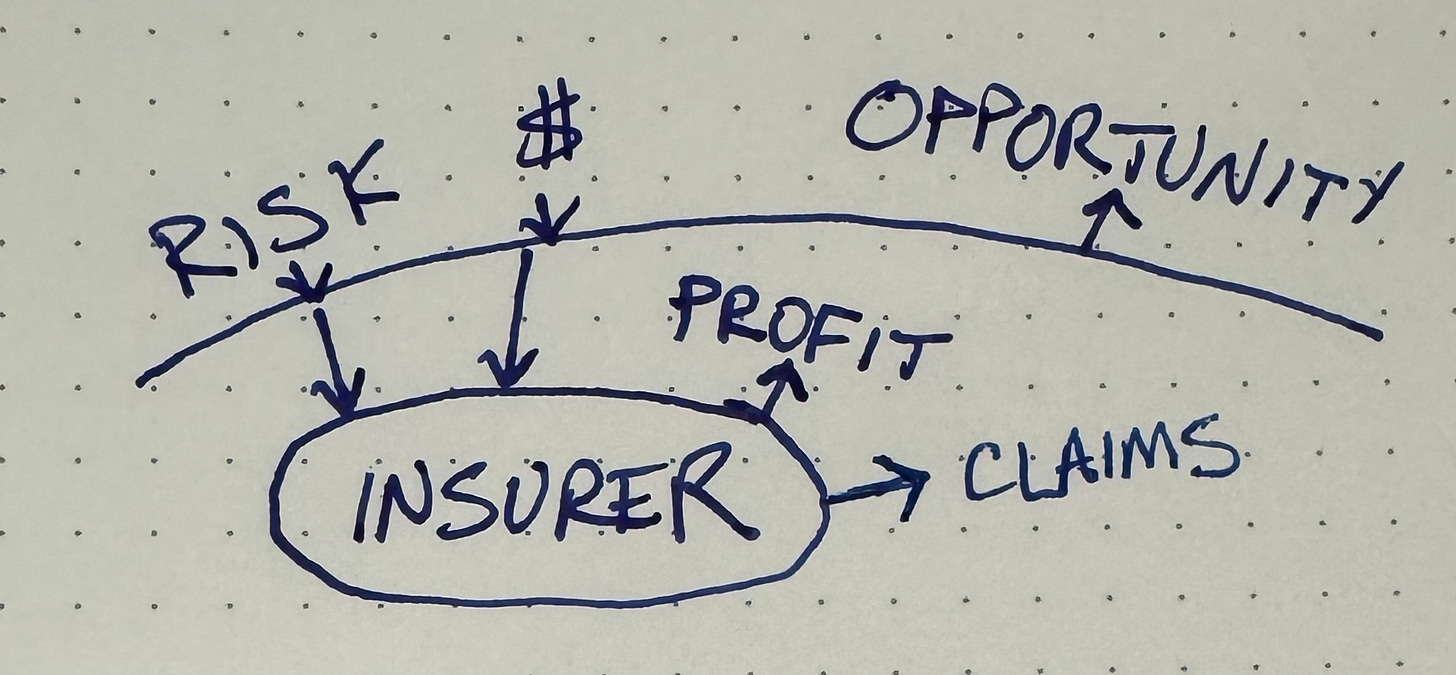

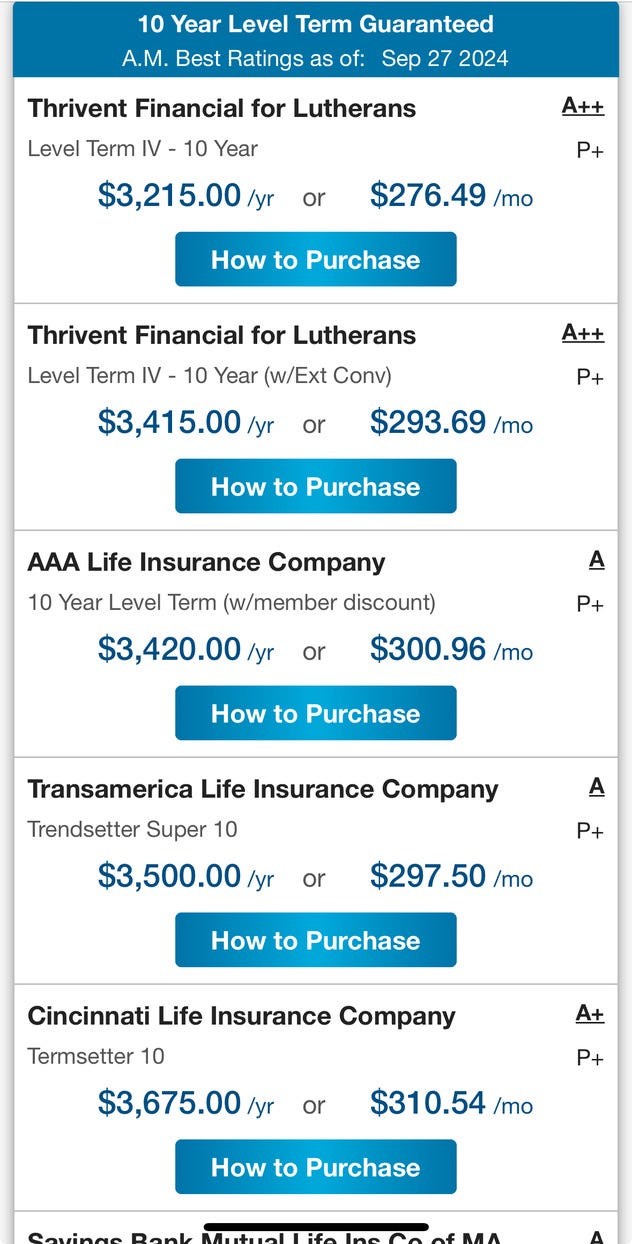

For example, according to the terms of my divorce agreement, I’m obligated to carry $1 million in life insurance coverage with my ex-wife as the beneficiary. Here’s what it looks like when I’m shopping for a policy.

I naturally want to pay as little as possible for this coverage, so I pick the vendor at the top. Turns out I’m not alone —the vast majority of shoppers [what is the percentage?] choose the cheapest policy. Why not? The service is a commodity.

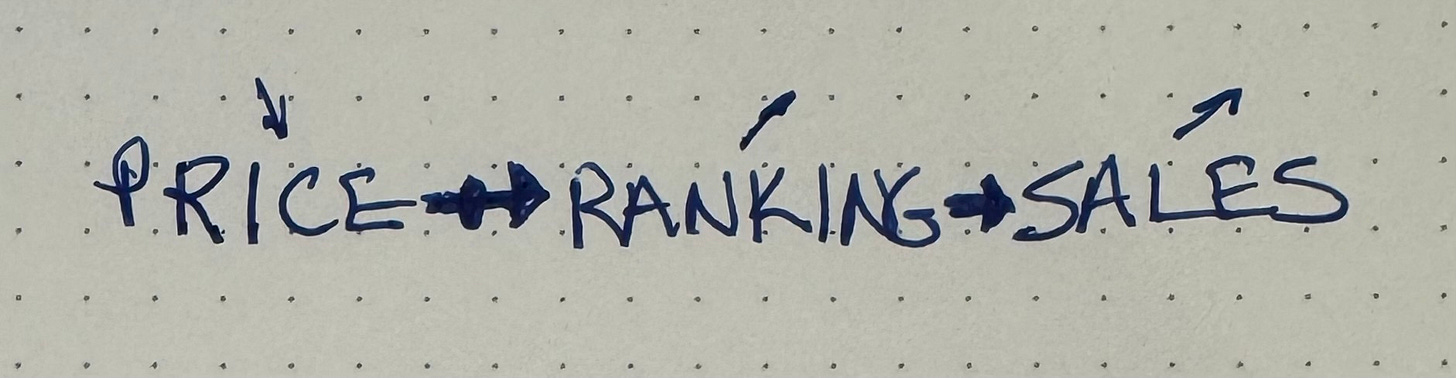

Imagine you’re an insurance company. You want to make more sales. You have to lower prices to get that coveted top spot.

(Read this is as: we push price down because that strongly effects ranking going up which strongly affects sales going up.)

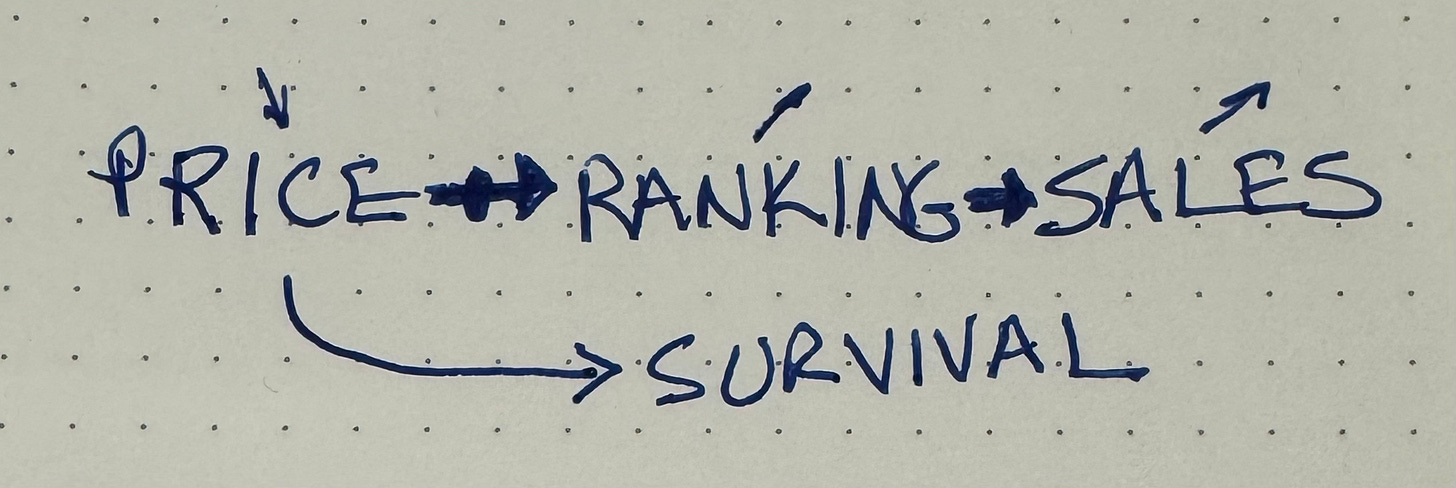

You can’t, though, in good faith or in fear of regulators, just lower your prices below profitability.

(Read this as: also, as price goes down, our chance of survival goes down. Whoopsie!)

What other levers are there? Another way to lower prices without affecting profit or survival is to take on less risk.

Those low prices are an illusion to me as a customer. The policy offered by the cheapest vendor requires that I prove that I’m not taking any risks. Not big risks like bungee jumping or hang gliding. I won’t be able to actually get a policy if I mountain bike. Or work on a container ship. Or god forbid that I actually survived cancer. The smallest additional risk increases prices & results in the vendor selling drastically fewer policies. The vendor excludes all possible risks.

Industry

If just one vendor faced these incentives, the industry as a whole would still create social value. However, every insurance company is trapped in the same game. In the struggle to claim that productive top spot, all insurance companies tend towards only writing policies for people who won’t conceivably submit a claim.

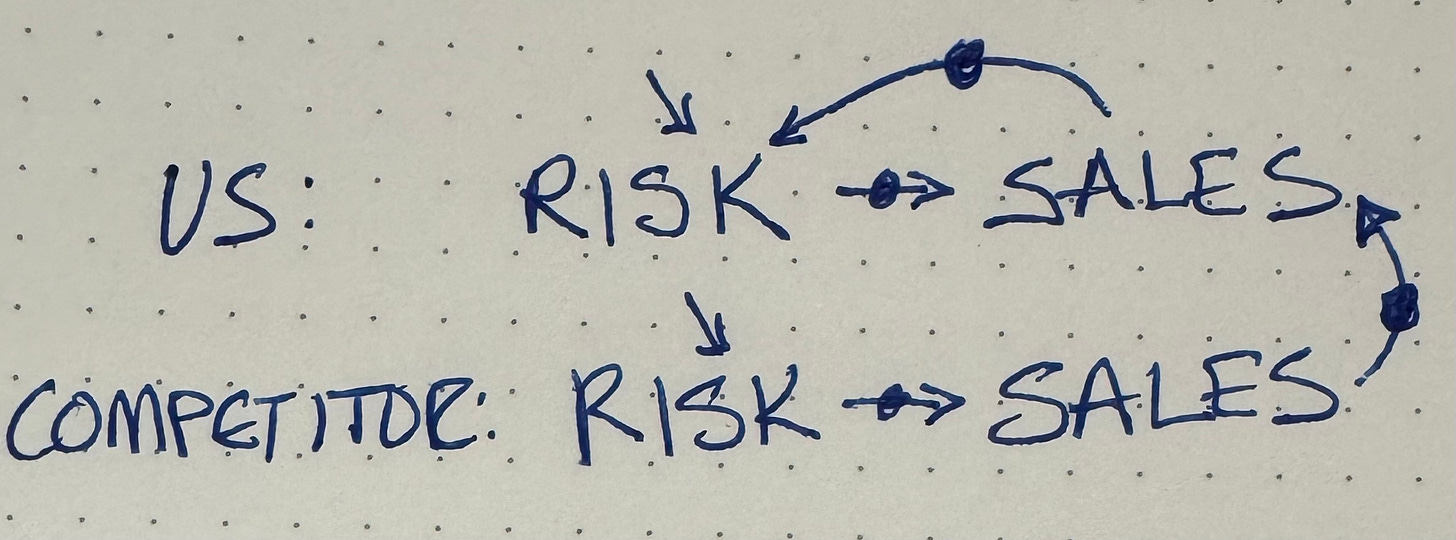

Both companies face the same incentives. But sales are (to a first approximation) a zero-sum game.

So we make the counter move & shave off even more risk to get back that coveted top spot.

But that cuts into our competitor’s sales, so they risk shave too.

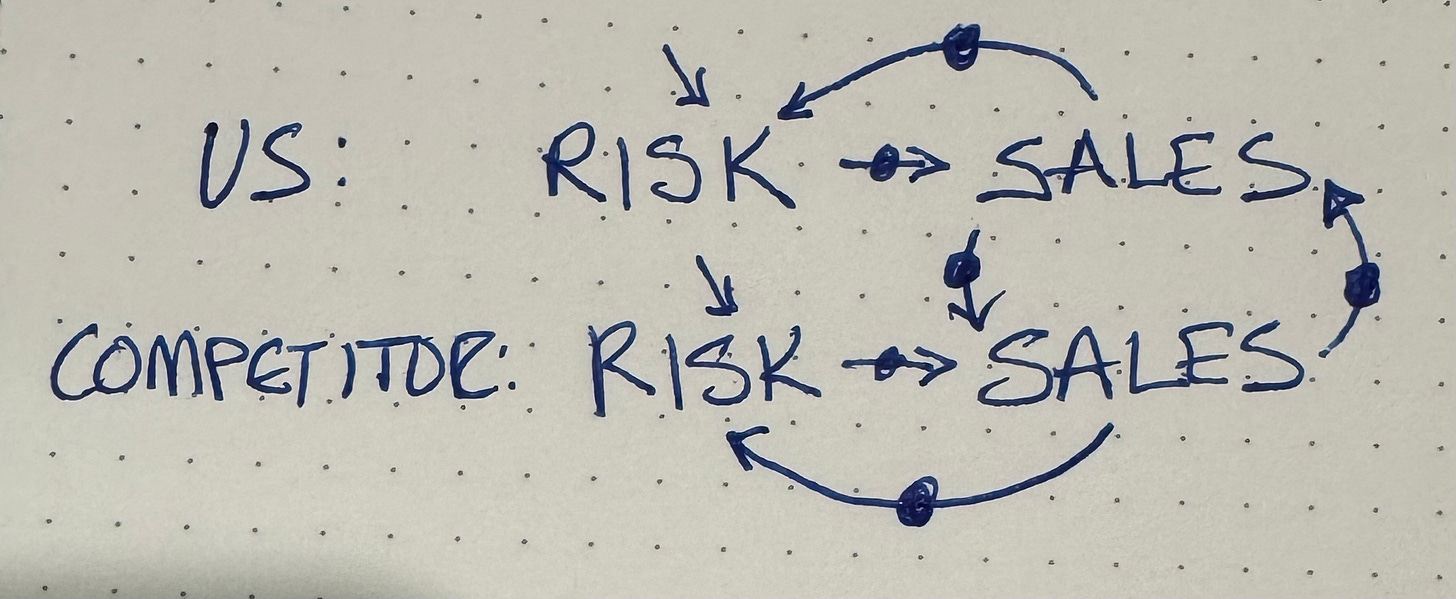

It’s at this point in a system diagram that I like to simplify. In short, the less risk we take, the less risk they take, all mediated through this “cheapest take all” sales process.

Every insurance company is part of this system. Collectively, the industry is shaving off the risk that could be turned into opportunity. The social benefit for which insurance was created is vanishing.

The companies aren’t doing anything morally wrong. If I was a short-term investor I would insist that they behave exactly as they are. What emerges from all of these rational decisions, though, is an industry failing society.

Remedy

One solution is to offer coverage for actual people, not for a theoretically perfectly safe customer. For example, SquareLife, Check24, and DeHoop have combined to offer individually priced life insurance in Germany. Every applicant is separately underwritten & priced. The result is a fair price for the risk & a sustainable business for the vendors. The combination of vendors is powerful:

DeHoop has spent the century underwriting non-standard risk, precisely to expand the social benefit of insurance.

Check24 is Europe’s largest comparison shopping site.

SquareLife efficiently administers special-purpose insurance policies.

Instead of being told, “Sorry, no insurance for you. You have a mildly risky job.”, these vendors can take into account significant health risks like addiction, obesity, or previous conditions & still write policies.

It is hard work to scale custom underwriting. However, it is possible. Without covering actual risk, the insurance industry risks social irrelevance. The insurance industry needs to abandon commoditization, embrace insuring actual people, & activate idle assets for society.

It’s always good news when I find a reinforcing loop that just happens to be running backwards from my goal. Reversing a reinforcing loop is a powerful lever for creating large changes to behavior with small changes to inputs. However, the system will have to change for society to recover the promised benefits of insurance.

I think this applies to private/for profit sectors of healthcare too: nurse practitioners are cheaper than doctors (who spend a lot more time in school and hands on training) so hospitals prefer to move as much patient care as possible to them (and hire fewer doctors).

Then, patient care suffers: misdiagnosed and incorrectly medicated patients die. And while it is possible to sue hospitals, it is too late and hospitals have evolved to cover up the misconduct (as a natural survival mechanism). And fire the NP to replace them with another MP isn’t a solution to the systemic issue of being profit driven without clear and direct accountability for patient outcomes. (And outcome driven medicine also has problems like panel shaping…)

https://archive.is/2024.11.22-235242/https://www.bloomberg.com/news/features/2024-11-22/what-happens-when-us-hospitals-binge-on-nurse-practitioners

Good insight, Kent !! Thank you . Could you please help with the below doubts:

- What is the difference between arrow (with circle dot) and arrow (normal one) ? - Also, does US imply us as in 'we' or as United States ?