Game Over Absorbs Future Winnings

The money you have in your pocket changes the expectation of a game.

I’ve enjoyed

’s book Ergodicity. It rewired my brain about the economics of software (more about this in the forthcoming book 2 of the Empirical Software Design series, Tidy Together?).As I do from time to time with books that changed me, I was reviewing my notes recently (if a book is affecting me, then there’s likely more that I missed the first time around). I came across an example & decided to expand on it to make sure I understood. Surprise, surprise, there was another layer there for me.

The Game

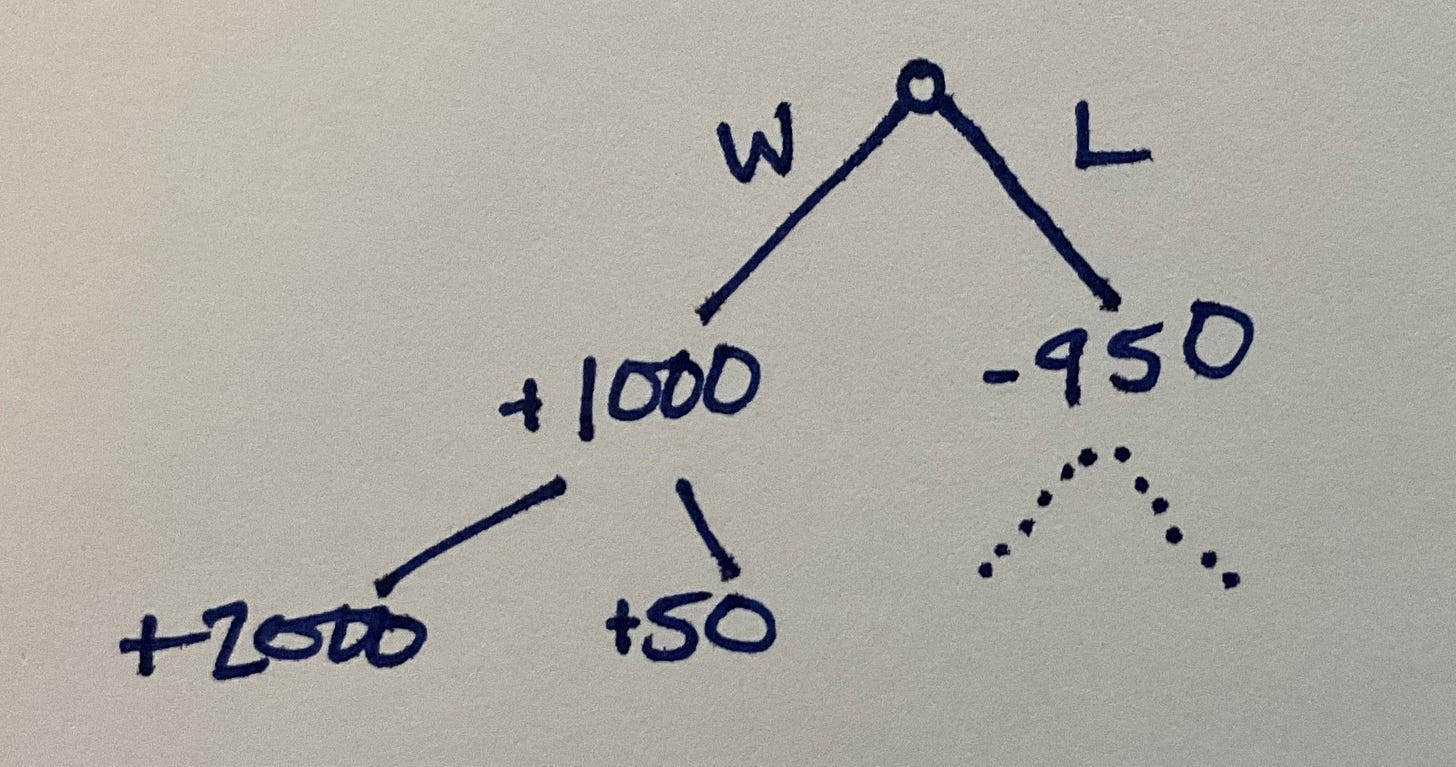

You flip a coin. Heads you win $1000. Tails you lose $950. Given a fair coin, the game is clearly profitable. Each of the 2 outcomes is equally likely, so the value of the game tree is $25 per round, the thousand you win minus the 950 you lose divided by the (equal) chance of each outcome.

Not so fast. It’s profitable at $25 per round as long as you can play it.

Let’s say you start with $1000 in your pocket. How much is the game worth now? (This is the example from the book.)

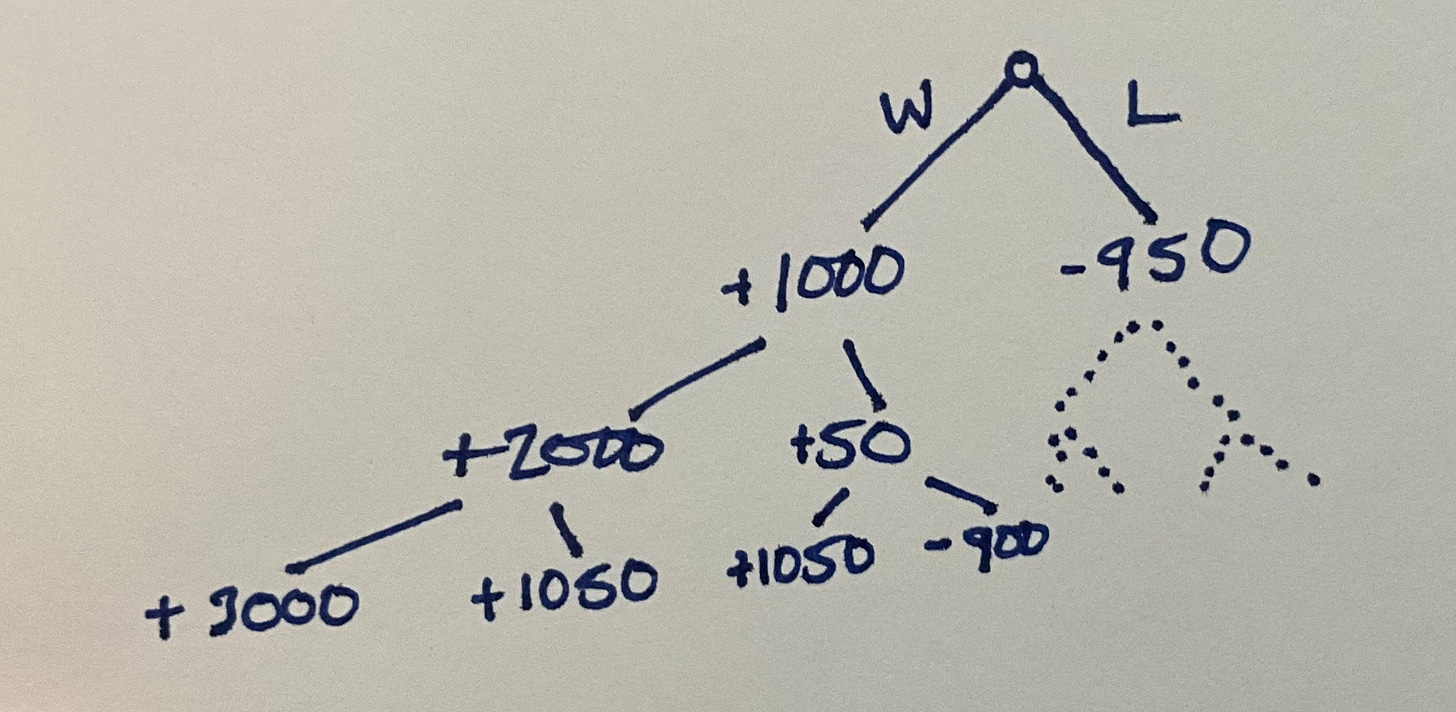

Now we have winnings of $2050 but we also have two “shadow” losses of $950. $150 / 4 outcomes = $37.50 for 2 rounds of the game. The game has gone from being worth $50 per round to being worth $18.75 per round.

Not a good trend, but how far does it go?

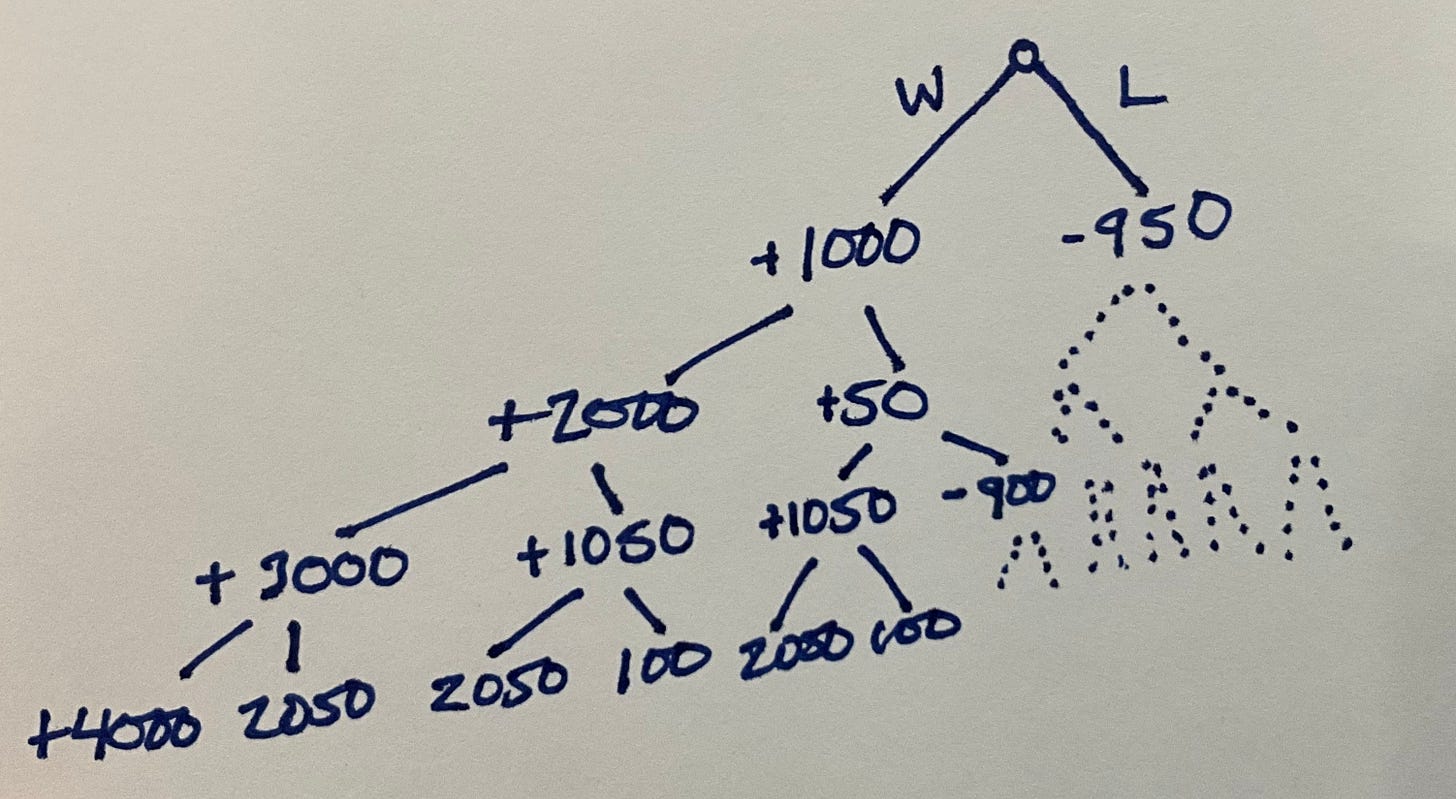

The next level of the game tree has $50 in profit for 3 rounds for $16.66 per round. And then?

Total profit for the 4th level? $14.84. Then $13.48 for the 5th. (Work the numbers yourself. I had several back & forths just now to get to numbers I trust.)

Application

One intuition here is that the more rounds of the game I can afford to play, the more the game is worth to me. Even if I only have so many seconds left on the planet, I can can extract more of the game’s value if I bet fewer of those seconds on each round. (Balanced with the loss of value because I’m betting less—see also Kelly Criterion.)

Think Weekly Planning. Think One Test At A Time. Think Throwaway Design Experiments. All of these have the effect of increasing the number of rounds of their particular game you can afford to play before you start winning.

Another intuition is the incredible cost of Game Over. Once your pocket is too empty to play the game, you keep paying for those missed opportunities to play profitable rounds of the game.

A final lesson is how great texts contain layers of lessons. I read Ergodicity carefully when it came out. Digging into it again today I still made mistakes demonstrating that I didn’t totally get it the first time nor this second time. Keep digging. Mix new materal with review of old.

You mentioned in a recent post that people don’t seem to recognize the cost of delays. I think I’m that way too, but this example makes me feel the cost. Maybe because it’s quantitative.

Thank you so much for the book reference, Kent! I confess I'm more interested in Ergodicity as it relates to financial investments, particularly the stocks vs. bonds allocation question, but I can always count on you to present topics whose value extends beyond software!